In recent months, inflation has started to slow. After several aggressive hikes in the federal funds rate, the goal of tempering inflation is beginning to show results. The inflation rate is approaching the Federal Reserve’s target rate of 2%, which indicates that efforts to cool down the overheated economy have been successful.

While inflation is easing, unemployment has seen a slight uptick, reaching 4.3%. Although still below the historical average of 5.7%, the increase signals a moderating labor market. The July 2024 jobs report shows that while the labor market remains strong, it’s beginning to cool off—a possible sign of a broader economic adjustment.

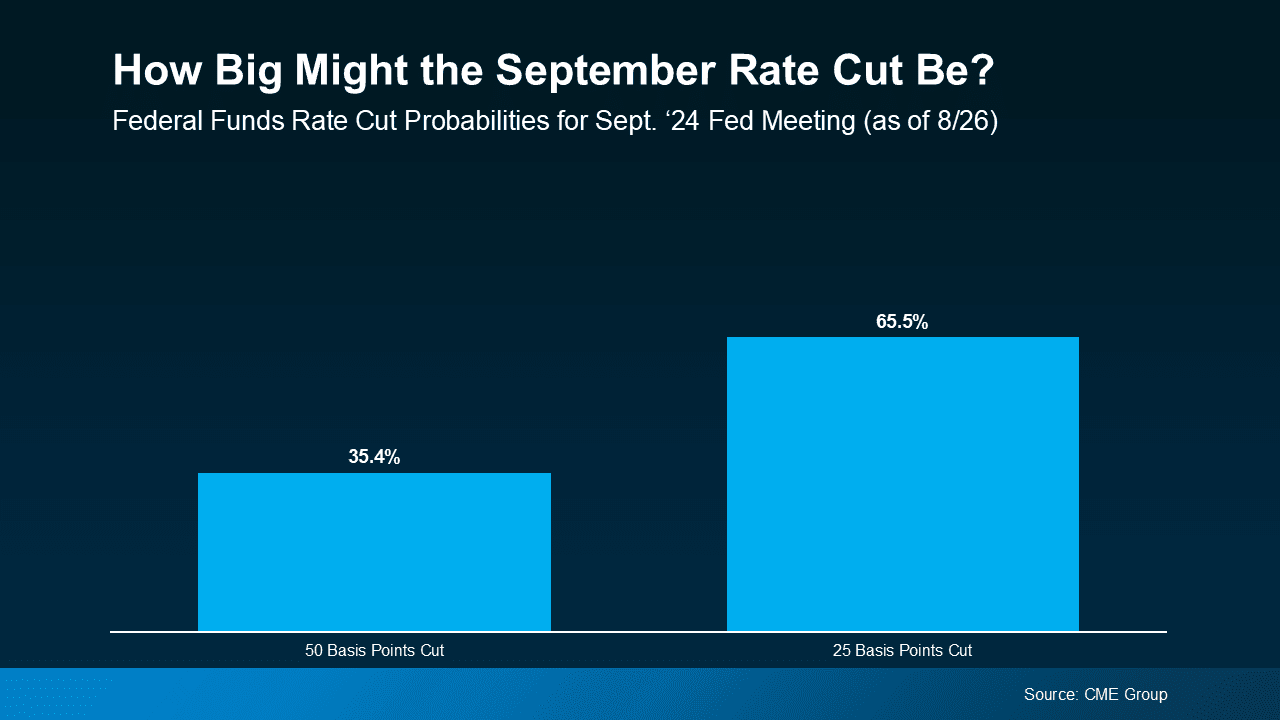

Economists are predicting a 65% chance of a 25-basis-point rate cut and a 35% chance of a 50-basis-point cut during this upcoming meeting. However, a single cut is unlikely to be the end of the rate-cutting cycle. Lawrence Yun, Chief Economist for the National Association of REALTORS® (NAR), suggests that we may see six to eight rounds of cuts throughout 2025 as the Federal Reserve works to balance the economy.

Mortgage rates have already begun to ease in anticipation of potential federal rate cuts. While these projections are difficult to predict with certainty, the gradual reduction in rates may have a small but positive impact on buyer confidence and activity. However, don’t expect dramatic drops in mortgage rates that would drastically alter the housing market.

For homebuyers, the easing of rates could create more favorable conditions, leading to increased interest in purchasing homes. However, the recent increase in housing inventory means that the market may remain balanced, with neither buyers nor sellers having a distinct advantage.

In terms of home values, the rate cuts could help keep prices strong, but the key message remains the same: it’s not about “timing the market,” but about “time in the market.” Over the long term, real estate has consistently proven to be one of the most reliable paths to building wealth.

In summary, while a federal rate cut is likely on the horizon, its immediate effects on the housing market will be modest. The broader impact may come through multiple rounds of rate cuts over the next year, contributing to a gradually improving environment for buyers and maintaining stability in home values.